How to stay IRS compliant with heavy highway use tax requirements in 2025

How to stay IRS compliant with heavy highway use tax requirements in 2025

Blog Article

List building is a big topic in Internet Marketing, but, if you haven't been around for a while and are unfamiliar with the basic building blocks of running a business online, you need to hear this.

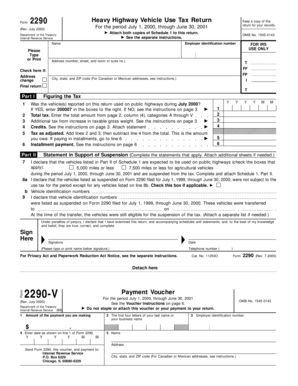

Vital Viral Pro is a traffic generation resource that is best suited for entrepreneurs that are already involved with home based opportunities. What makes VVP so awesome is 2290 tax form that it comes with a built in downline builder. Marketers can get their hands on banners, text ads, and branding materials to help them increase their incomes by growing their business.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

There are some concerns when it comes to these high powered batteries and how good they are for the environment. But all hybrid batteries are set to be recycled (Toyota has a $200 bounty on IRS Form 2290 each battery pack), and so unlike some lead batteries from conventional cars, they shouldn't end up in landfills.

Individuals who want to get the software can either buy the program or get one that is absolutely free. Here are a few examples of those that IRS heavy vehicle tax are available.

The tax account transcript is the best of the two because it will include any adjustments that were made after you filed. The type of information included are your adjusted gross income, taxable income, your marital status and whether you filed a long or short form 1040.

"It's better late than sorry." Plan extra time and arrive safely. Take breaks for 15 to 20 minutes every few hours and stretch your legs. Don't forget to drink plenty of fluids. Don't eat and run. Take a walk after eating to get your blood flowing.